Understanding Survey Sample Size

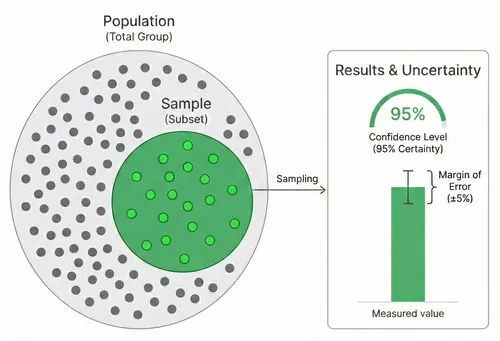

You don’t need to survey everyone to get reliable results. A properly sized sample can represent a much larger population with known accuracy.

This guide explains how sample size works, why it matters, and how to avoid common mistakes. Use the Sample Size Calculator to calculate your required sample size.

Why Sample Size Matters

Sample size affects two key factors:

- Margin of error: How close your sample results are to the true population value

- Confidence level: How certain you can be that your results fall within the margin of error

Get the sample size wrong, and you’ll either waste resources surveying too many people or get unreliable results from too few.

Key Concepts

Population Size

The total number of people who could take your survey. This might be:

- All your customers (e.g., 50,000)

- Employees in your company (e.g., 500)

- Users of a specific feature (e.g., 10,000)

- Visitors to your website last month (e.g., 100,000)

For very large populations (100,000+), sample size barely changes because you’re already capturing statistical significance.

Confidence Level

How certain you want to be that your sample results reflect the true population.

| Confidence Level | Interpretation |

|---|---|

| 90% | You’re 90% sure the true value falls within your margin of error |

| 95% | Industry standard - 95% certainty |

| 99% | Very high certainty, requires larger sample |

Use 95% unless you have a specific reason to change it. It’s the standard for business decisions.

Margin of Error

The acceptable range of error in your results. If your survey shows 60% satisfaction with a ±5% margin of error, the true value is between 55% and 65%.

| Margin of Error | Use Case |

|---|---|

| ±3% | High-stakes decisions requiring precision |

| ±5% | Standard for most business surveys |

| ±10% | Exploratory research or resource-constrained surveys |

Smaller margins require larger samples. A ±3% margin needs roughly 2.5× more responses than ±5%.

The Sample Size Formula

This guide uses Cochran’s formula adjusted for finite populations.

Step 1: Calculate Initial Sample Size (Infinite Population)

n₀ = (Z² × p × (1-p)) / e²Where:

- Z = Z-score for your confidence level (1.96 for 95%)

- p = Expected proportion (0.5 for maximum variability)

- e = Margin of error as decimal (0.05 for 5%)

Step 2: Adjust for Finite Population

n = n₀ / (1 + (n₀ - 1) / N)Where:

- N = Your population size

- n₀ = Initial sample size from step 1

You don’t need to solve this manually-this is what the calculator does.

Why We Use p = 0.5

The proportion (p) represents expected response distribution. If you’re asking a yes/no question, p = 0.5 means you expect a 50/50 split.

We use 0.5 because:

- It produces the largest (most conservative) sample size

- You don’t need to guess what results you’ll get

- It’s the safest assumption when you don’t have prior data

If you know your proportion is extreme (e.g., 90% yes), you can use a smaller sample-but only when you have strong prior data.

Response Rates & Invitations

Your required sample size is not the number of people to invite. You need to account for response rates.

Typical Survey Response Rates

| Survey Type | Response Rate |

|---|---|

| In-app/embedded | 20-40% |

| Email (customers) | 10-30% |

| Email (employees) | 30-50% |

| Post-transaction | 15-25% |

| NPS relationship surveys | 10-20% |

Formula: People to invite = Sample size ÷ Expected response rate

If you need 400 responses and expect 20% response rate:

- 400 ÷ 0.20 = 2,000 people to invite

Common Mistakes

Ignoring response rates

Calculating you need 400 responses but only inviting 400 people guarantees insufficient data.

Using population size for sample size

“We have 10,000 customers, so we need 10,000 responses.” You don’t. Around 370 responses give you ±5% accuracy.

Forgetting about subgroups

If you plan to analyze by segment (region, product, customer type), each subgroup needs adequate sample size. You might need 400 responses per segment, not 400 total.

Not considering non-response bias

If only happy customers respond, your results won’t represent everyone. Aim for response rates above 20% to minimize bias.

Over-precision

A ±3% margin sounds better than ±5%, but it requires 2.5× more responses. For most business decisions, ±5% is sufficient.

When Sample Size Rules Don’t Apply

Standard sample size calculations assume:

- Random sampling: Everyone has equal chance of being selected

- Representative responses: Respondents are similar to non-respondents

- Single population: You’re measuring one group, not comparing groups

These assumptions break down when:

- You’re surveying self-selected volunteers

- Response rates are very low (under 10%)

- You’re running a longitudinal study

- You have highly niche populations

In these cases, statistical accuracy depends more on sampling method than sample size.

Best Practices

Define your population clearly

Who exactly are you surveying? “Our customers” is vague. “Active customers who made a purchase in the last 12 months” is specific.

Use stratified sampling for diverse populations

If your population has distinct segments, sample proportionally from each to ensure representation.

Plan for analysis upfront

If you’ll break down results by region, ensure each region has enough responses. Three respondents from Asia isn’t statistically meaningful.

Document your methodology

Note your population size, sampling method, response rate, and margin of error. This adds credibility to your findings.

Consider the decision at stake

A ±10% margin might be fine for exploratory research. For decisions affecting millions of dollars, invest in ±3% precision.

Frequently Asked Questions

What if I don’t know my exact population size?

Estimate conservatively. If you think you have 5,000-10,000 customers, use 5,000. For very large populations (50,000+), the exact number barely matters.

Is bigger always better?

Not necessarily. Beyond your minimum sample size, additional responses have diminishing returns. Going from 400 to 4,000 responses changes margin of error from ±5% to ±1.5%-rarely worth the effort.

What about qualitative feedback?

Sample size calculations apply to quantitative data (numbers, percentages). For open-ended questions, you’ll often reach “saturation” (no new themes emerging) with 20-30 thoughtful responses.

How do I increase response rates?

- Keep surveys short (5 minutes max)

- Send at optimal times (Tuesday-Thursday, 10am-2pm)

- Use personalization in invitations

- Explain why feedback matters

- Offer incentives if appropriate

Next Steps

Use the Sample Size Calculator to determine your target, then check out our survey templates to get started.